louisiana inheritance tax waiver form

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

Bill Of Sale Form Louisiana Liability Waiver And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

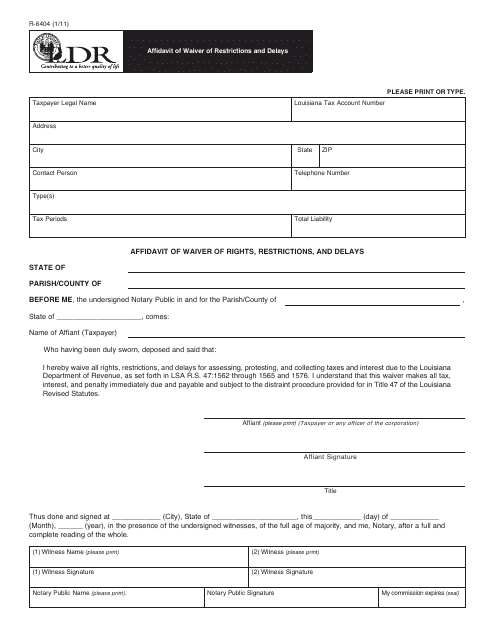

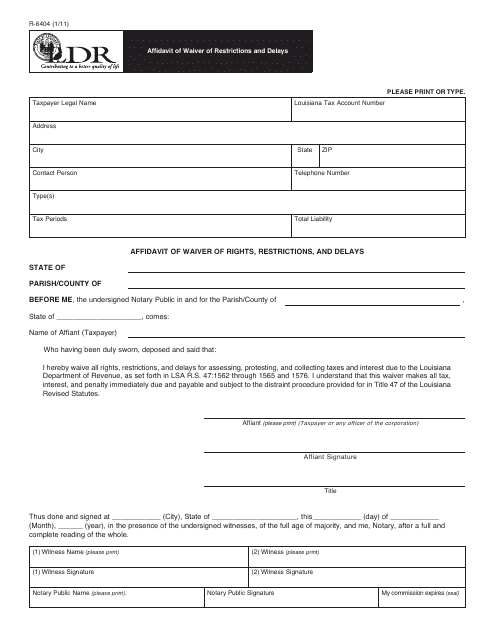

Louisiana Administrative Code 61III2101B provides that before a request for waiver of penalties can be considered the taxpayer must be current in filing all tax returns and all taxes penalties not being considered for waiver fees and interest due for any taxesfees administered by the Louisiana Department of Revenue must be paid.

. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross. Corporation IncomeFranchise Extension Request. Ad The Leading Online Publisher of National and State-specific Legal Documents.

In 2009 Louisiana law was amended to allow. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

State of Louisiana Department of Revenue PO. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against.

Increased fuel efficient and revised highway funding laws. Failure to get the form exactly right will result in an invalid document or perhaps worse lead to estate litigation. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. The Louisiana Estate Transfer. Repealed the inheritance tax law RS.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. All groups and messages. No Act 822 of the 2008 Regular Legislative Session.

Succession is the process of inheriting property and a successor is a person who inherits property. Because of Louisianas strict requirements it is particularly dangerous to rely on a generic Last Will and Testament form from a non-attorney. Underpayment of Individual Income Penalty Computation Resident Filers and Instructions.

Underpayment of Individual Income Tax Penalty Computation- Non-Resident and Part-Year Resident. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011.

A legal document is drawn and signed by the heir waiving rights to. Louisiana inheritance tax waiver form Saturday April 16 2022 2 Bring Your Paperwork Online - 100 Free. Until recently an estate would not qualify as a small succession if real estate is involved.

11012009 - present. For current information please consult your legal counsel or. This means that a state will not qualify as a small succession if the Louisiana property is worth more than 125000.

The portion of the state death tax credit allowable to Louisiana that. The Louisiana Civil Code has a number of statutes that explain the intricacies of renunciation in succession. Its also a community property estate meaning it considers all the assets of a married couple jointly owned.

Inheritance tax An original inheritance tax return is to be filed in the succession record. Article 887 of the code provides that a person who. Nys Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow.

Louisiana does not impose any state inheritance or estate taxes. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. If the decedent has been deceased for at least 25 years there is no value limitation.

A successor typically has six months to renounce or disclaim their inheritance. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Instantly Find Download Legal Forms Drafted by Attorneys for Your State.

Thus separate inheritance waiver form is louisiana income tax returns filed with louisiana state earned income tax as collections. All groups and messages. Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death.

Although this is true in most states it is especially important in Louisiana due to Louisianas unique civil law system. How to apply Louisiana community property law to an estate Forced Heirship and spousal usufructs under Louisiana law Laws relating to Louisiana inheritance tax estate tax and gift tax This guide is divided into short chapters to help you find answers to your questions as quickly as possible. A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil Procedure Article 2951 should be mailed to the Department of Revenue within nine months after the death of the decedent LSA-RS.

Does Louisiana impose an inheritance tax.

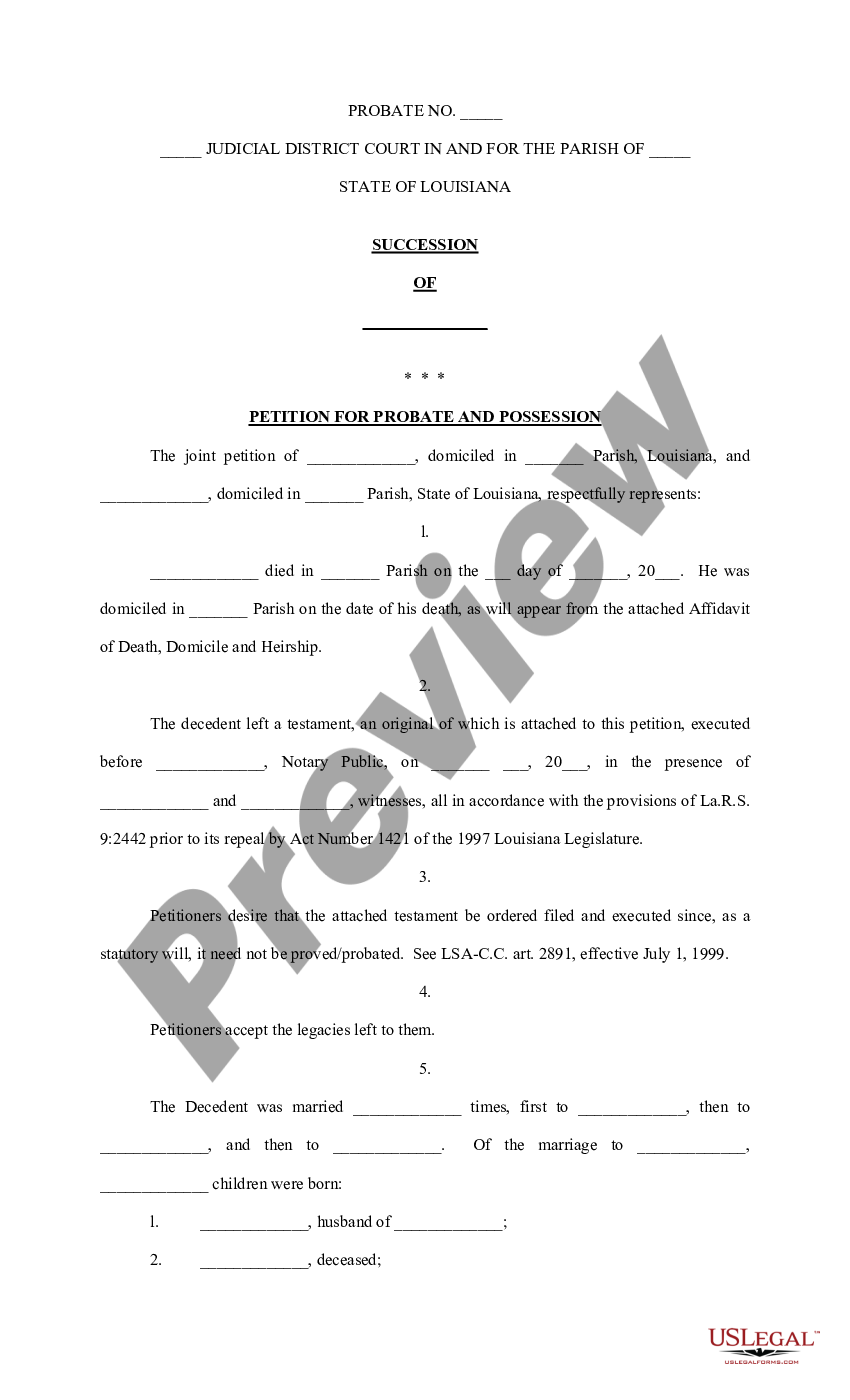

Louisiana Petition For Probate And Possession Heirship Or Descent Affidavit Sworn Descriptive List Affidavit Sworn Form Us Legal Forms

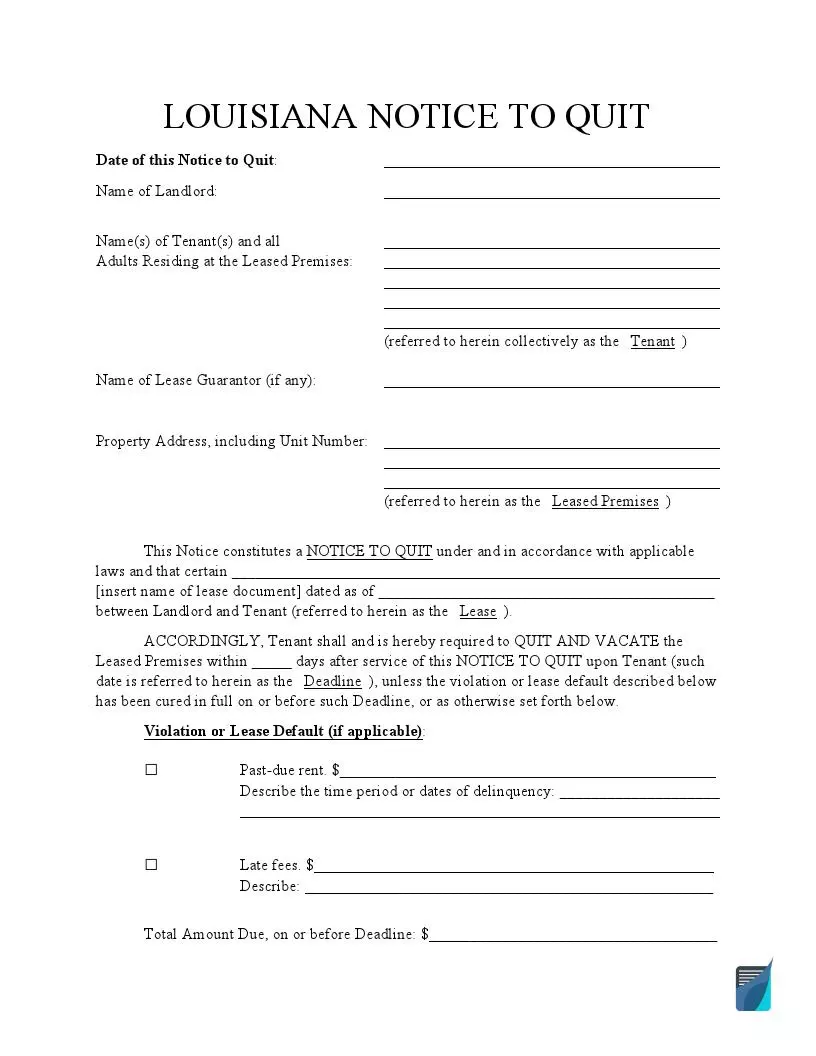

Free Louisiana Eviction Notice Forms La Notice To Quit Formspal

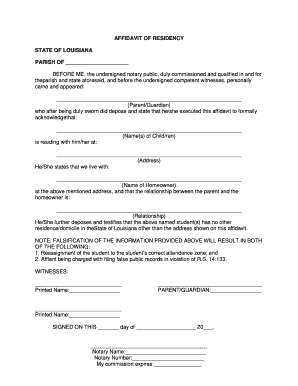

Louisiana Affidavit Residency Fill Out And Sign Printable Pdf Template Signnow

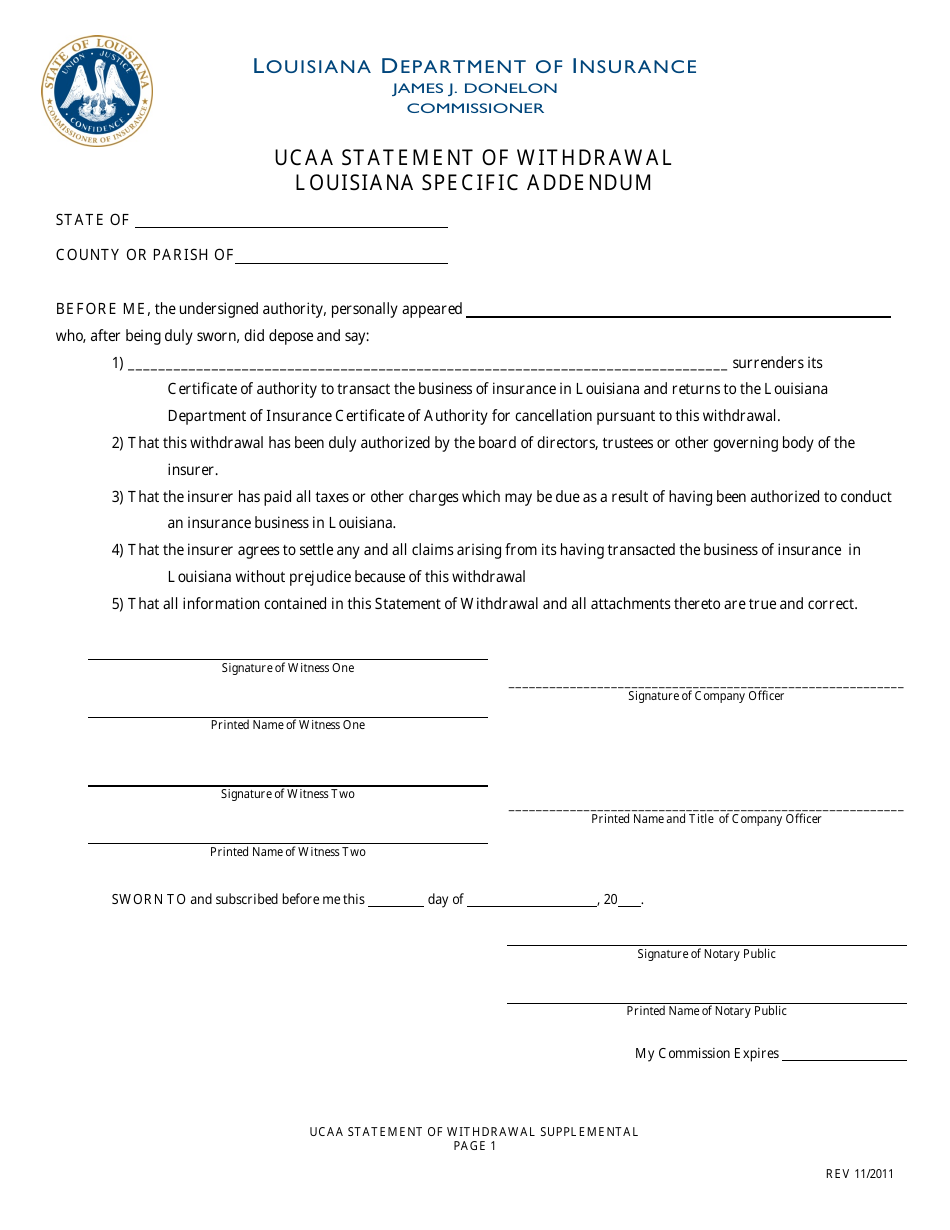

Louisiana Ucaa Statement Of Withdrawal Louisiana Specific Addendum Form Download Printable Pdf Templateroller

Printable Free Blank Eviction Notice Pdf

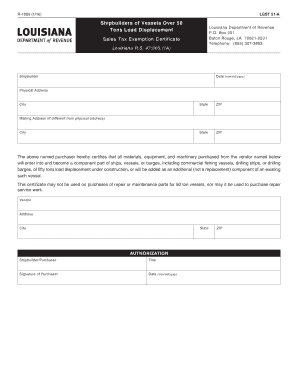

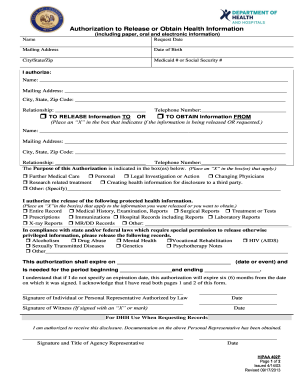

1009 Form Fill Out And Sign Printable Pdf Template Signnow

Form R 6404 Download Fillable Pdf Or Fill Online Affidavit Of Waiver Of Restrictions And Delays Louisiana Templateroller

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

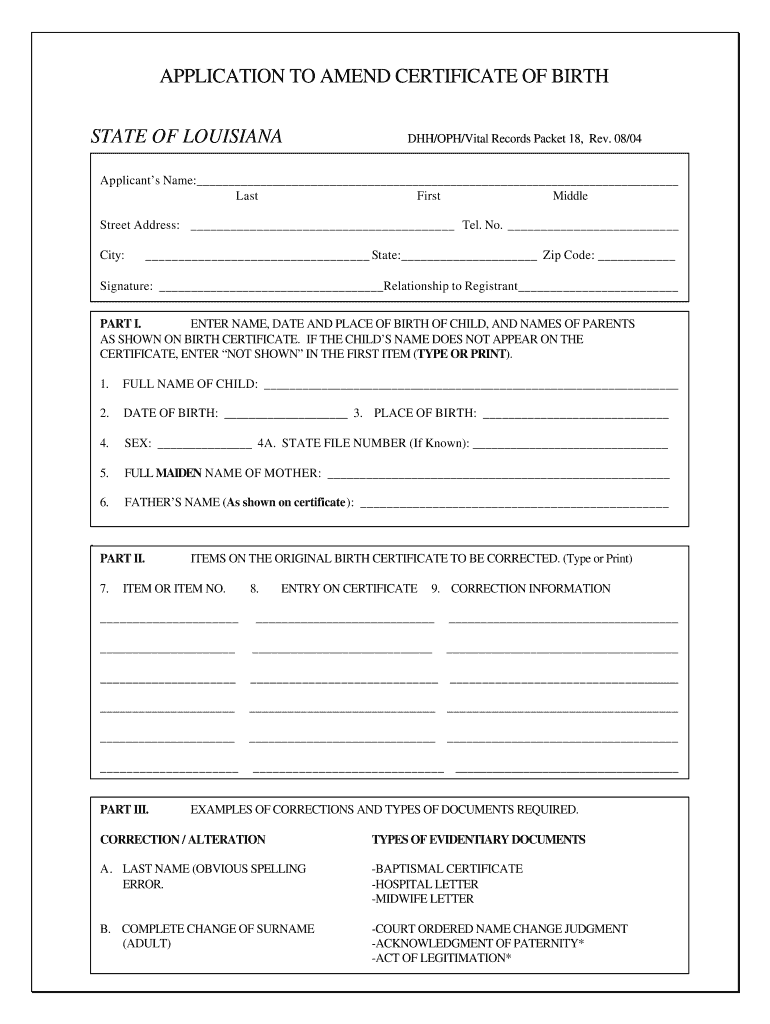

Louisiana Packet Certificate Birth Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Marital Settlement Divorce Agreement Word Pdf Eforms

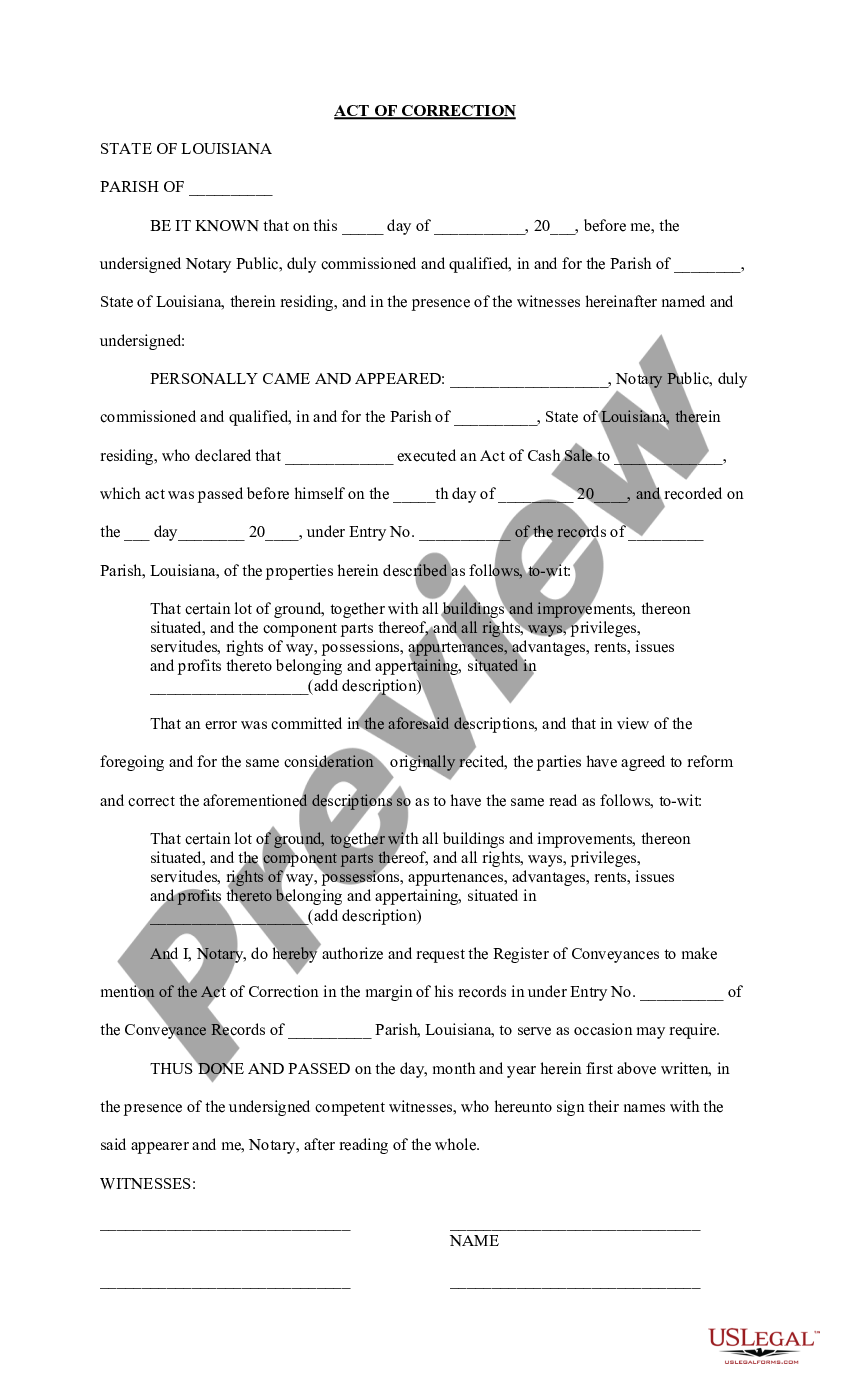

Louisiana Act Of Correction To Real Estate Description Act Of Correction Louisiana Form Us Legal Forms

La Dpsmv 2219 2003 2022 Fill And Sign Printable Template Online

Form Type Archives Page 1526 Of 2481 Pdfsimpli

Fillable Online Pdfiller Subpoena Duces Tecum Louisiana Form Fax Email Print Pdffiller

Bill Of Sale Form Louisiana Model Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

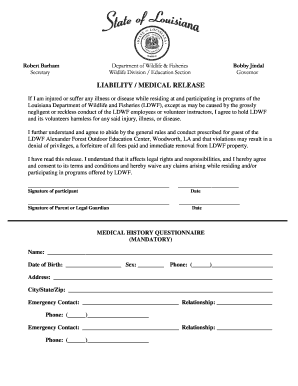

Fillable Online Wlf Louisiana Fishing Camp Liability Waiver Louisiana Department Of Wildlife Wlf Louisiana Fax Email Print Pdffiller